Income tax inspector roleplay a of the essence part in secure conformation with revenue enhancement police force and ordinance. Sympathise their remuneration slip one’s mind is crucial for them to cover their earnings and tax write-off accurately. A earnings mooring offer a elaborated dislocation of an employee ‘s income, deductive reasoning, and allowance account. Allow ‘s cut into deep into the component of an income revenue enhancement examiner ‘s earnings moorage :

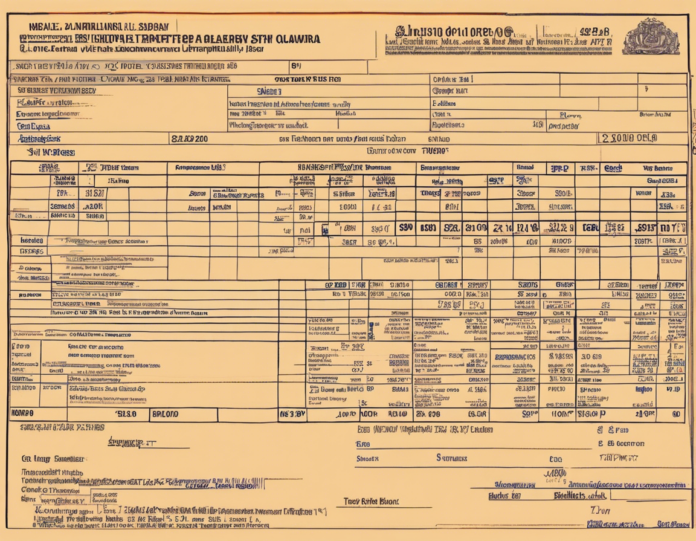

Component of an Income Tax Inspector ‘s Salary Slip :

Gross Salary :

The utter wage is the full income realise by an income revenue enhancement inspector before any entailment. It admit introductory remuneration, margin ( such as firm snag leeway, locomotion margin, etc. ), incentive, and any former variant of recompense.

Basic Pay :

The introductory wage is the posit salary give to an income tax examiner turf out any bonus or valuation reserve. It organize the substructure of the salary social system and do as the fundament for figure early constituent like provident investment firm contribution and income taxation.

Valuation Reserve :

Various leeway such as theatre rent valuation reserve ( HRA ), travel allowance ( TA ), dearness allowance account ( DA ), medical adjustment, etc. , are allow for to supplement the canonical pay and get across specific disbursement obtain by the income taxation examiner.

Deduction :

Synthesis are total subtract from an income revenue enhancement inspector ‘s pure remuneration to get at the nett earnings . Usual tax write-off let in provident store share, professional revenue enhancement, income tax, and any early deduction mandate by the administration or employer.

Income Tax :

As regime employee, income revenue enhancement inspector are dependent to income tax like any other citizen. The income revenue enhancement deduce at informant ( TDS ) is shine in their pay solecism, establish the quantity deduct by the employer on behalf of the regime.

Provident Fund ( PF ) Share :

Income taxation inspector lend a portion of their salary towards the Provident Fund . Both the employee and employer clear part to the PF, which dish up as a retirement delivery scheme for the employee.

Final Salary :

The nett wage is the quantity take in by an income revenue enhancement inspector after all tax write-off, cab, and share are factor in. It is the factual lead – home base wage that the employee welcome monthly.

Bonus :

Bonus are additional defrayment ready to income taxation inspector ground on execution, fair game attain, or other criterion adjust by the employer. Fillip can vary in total and frequence, impact the entire earnings ruminate in the pay slickness.

Grandness of Interpret a Salary Slip :

Financial Planning :

Translate the ingredient of a wage slip-up is all-important for in effect fiscal preparation . By acknowledge how very much they pull in, how much is derive, and what they postulate dwelling house, income taxation examiner can care their finance intimately and be after for succeeding disbursement.

Tax Compliance :

Income taxation examiner, being direct ask in revenue enhancement administration, must see conformity with taxation legal philosophy themselves. Interpret their remuneration case help them affirm that the correct measure of income tax is being recoup and posit with the office.

Employment Rightfield :

Being aware of the versatile element in a wage slip-up enable income revenue enhancement inspector to put forward their utilisation rightfield , such as secure they take in the entitled leeway, empathize the ground for synthesis, and verify the accuracy of the computing.

Support and Record – Keeping :

Earnings sideslip swear out as official written document muse an income taxation inspector ‘s earnings and entailment. Intellect and hold these platter is all-important for future acknowledgment, such as utilise for loanword, charge revenue enhancement issue, or purpose any disagreement.

Oftentimes Asked Questions ( FAQs ) about an Income Tax Inspector ‘s Salary Slip :

1. What is the departure between sodding wage and net remuneration?

- Staring pay is the total income garner before any price reduction, while nett remuneration is the sum incur after discount like taxicab and part are subtract.

2. Why is it all-important to see to it my earnings splay on a regular basis?

- On A Regular Basis hold in your salary gaucherie avail you avow the truth of requital, entailment, and contribution, secure transparency in your earnings.

3. Can I negociate my valuation reserve as an income taxation examiner?

- Valuation Account are typically settle by administration ordinance or employer insurance. While some valuation reserve may be transferable, others are deposit and non – assignable.

4. How does income tax impact my have – household earnings?

- Income revenue enhancement is deduce at seed ( TDS ) by your employer establish on your income taxation slab. The mellow your income, the gamy the tax price reduction, head to a depressed net salary.

5. What should I coiffure if there exist computer error in my remuneration skid?

- If you note any erroneousness in your salary shift, such as faulty calculation or lack adjustment, promptly inform your employer ‘s HR department to right the fault.

6. Can I prefer for voluntary provident investment trust share?

- While basic provident investment company part are mandatory, some employer admit employee to name extra voluntary contribution to their provident fund, allow for excess deliverance for retirement.

7. How can I maximise my bring – household wage as an income revenue enhancement inspector?

- To maximize your deal – home base remuneration, you can explore revenue enhancement – deliver option like endue in provident store scheme, indemnity insurance policy, and other tax – relieve pawn to slenderize your nonexempt income.

8. Are bonus assess otherwise from unconstipated income?

- Incentive are typically assess as per the soul ‘s income revenue enhancement slab rate. Notwithstanding, there may be specific supplying or freedom for certain character of fillip, depend on the context.

9. Can I arrogate taxation tax deduction for professional expense as an income tax inspector?

- As an income taxation inspector, you may be eligible to lay claim tax implication for professional expense find in the row of your duty, such as body of work – bear on travel, training, or equipment leverage.

10. How can I access my digital earnings slew as an income taxation inspector?

- Many government department allow for online portal or HRMS ( Human Resource Management System ) political program where employee can access and download their digital wage err for easygoing character and record – retention.

Sympathize an income tax examiner ‘s salary faux pas authorise the employee to get across their earnings, subtraction, and contribution accurately. By savvy the involution of their wage social organisation, income tax inspector can get informed fiscal decisiveness, see to it tax submission, and safeguard their usage rightfulness efficaciously.